Average is the new up! And above average could be the start of a new trend in Greater Vancouver real estate. Attached are the Sales and Listings Statistics updated to the end of October 2019. This October in the Greater Vancouver real estate market saw a significant increase in the amount of sales compared to October of last year. Buyers are clearly engaging; some home sellers are still reluctant to sell at today’s prices or are simply not engaging at all and the opportunities seen for buyers earlier in the year are diminishing. And with CMHC coming out recently and saying, “The Metro Vancouver Housing Market will see higher sales and modest price increases over the next two years. Resale activity and house prices are expected to fully recover from the recent decline.” The question of “When will we hit the bottom of the market” looks to have been answered with “we already have and are past that point.”

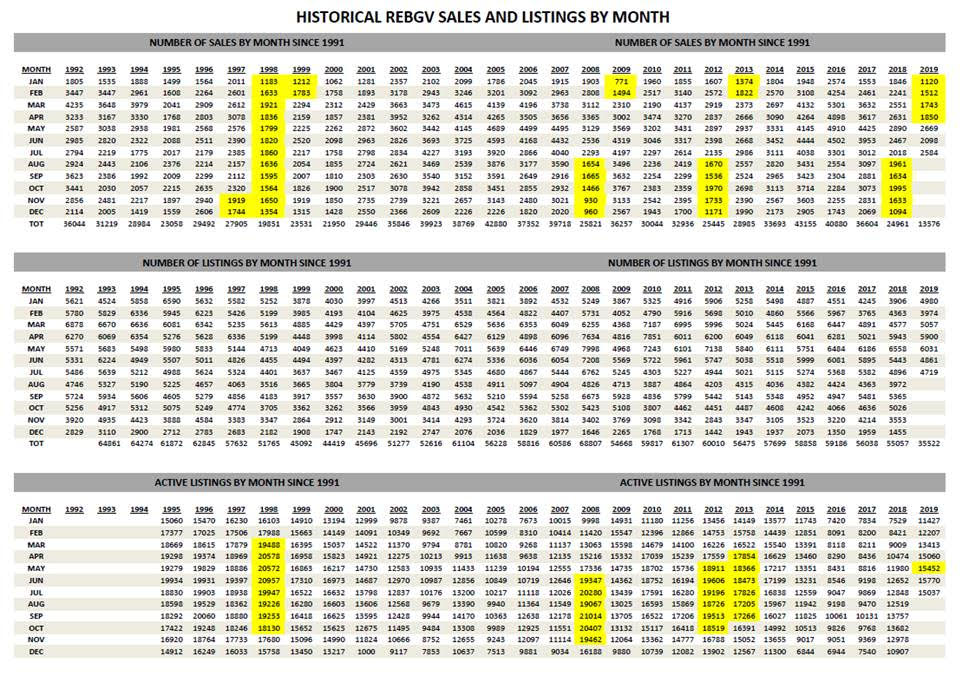

There were 2,892 homes sold of all types in Greater Vancouver in October this year compared with 2,363 homes sold last month, 1,995 sales in October last year and 3,073 homes sold in October 2017. October sales were 9 per cent above (yes that’s correct, above) the 10-year average for the month of October and actually 5 per cent above the 20-year average This was a 45 per cent increase in homes sold compared to October 2018, the same as September in comparison to the previous year. October sales were the highest monthly sales since October 2017. Activity noticeably accelerated towards the end of the month. Perhaps we should save the felines and not call this a “Dead Cat Bounce” but classify it as pent up demand actually coming forward and engaging in the market. It’s the fourth straight month of home sales being higher compared to the same month in the previous year after 17 straight months of those sales being lower compared to the previous year.

Some highlights from October:

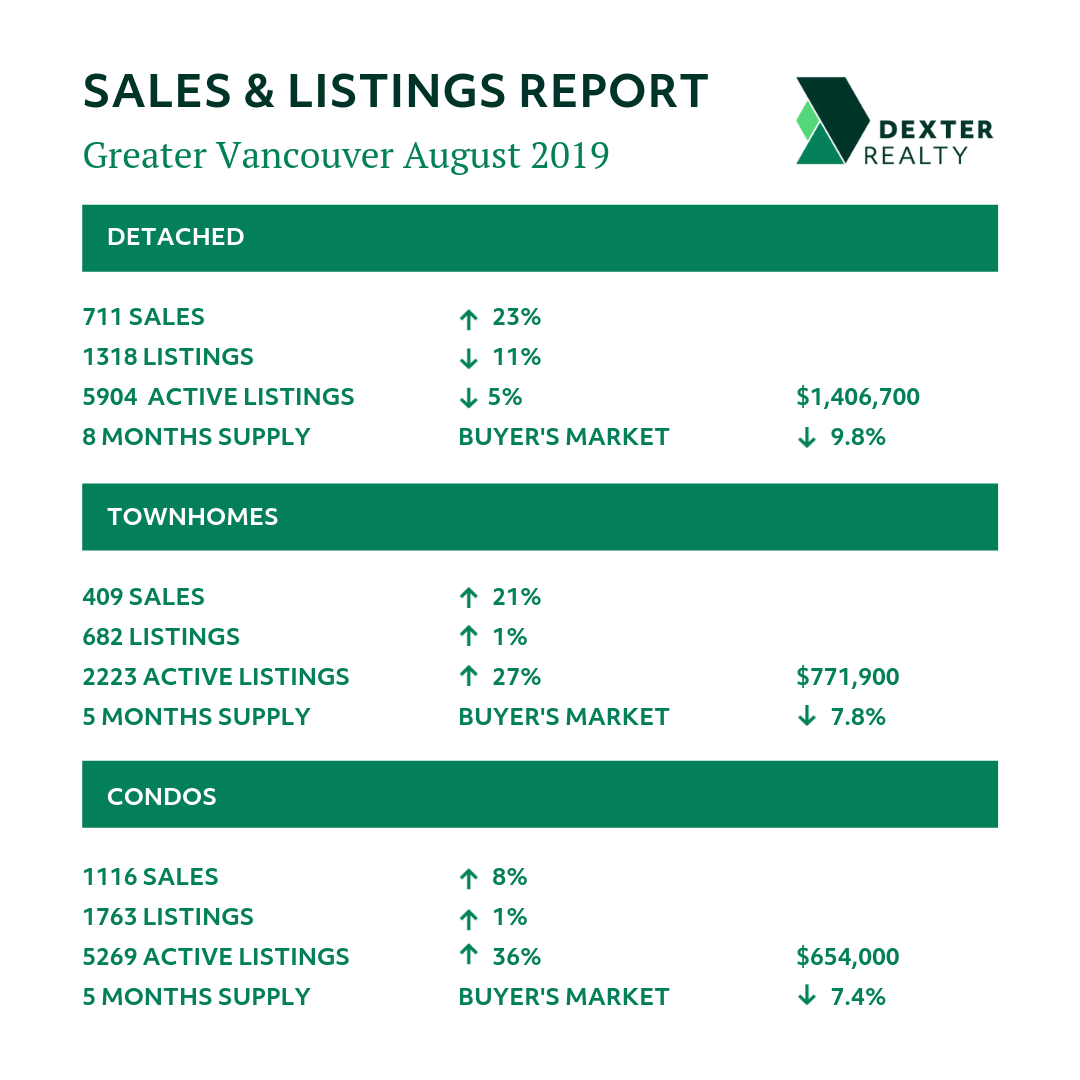

Detached home sales again showed a significant year over year gain this month, up 45 per cent with townhomes up 55 per cent

Vancouver and North Vancouver showed stronger year over year sales for townhouses and condos in October

Sales of detached homes and townhouses in Richmond showed significant growth this month after being more stagnant in the previous two years, up 83 per cent and 80 per cent year over year respectively while condos were only 21 per cent higher compared to October 2018

Sales of townhouses and condos in Port Moody were 136 per cent and 78 per cent higher year over year this October with both showing months of supply at 2 months – indicators of a shift to seller’s market conditions

Coquitlam detached home sales were 115 per cent higher year over year in October

There were 943 detached houses sold in October 2019 up from 642 (46 per cent) in October 2018 in Greater Vancouver, with a 7.5 per cent decrease in the benchmark price of these homes year over year. For townhouses there were 536 sales in October 2019 compared to 344 in October 2018 (up 55 per cent) with a 5.8 per cent decrease in the benchmark price year over year; and for condos there were 1,384 sales in October 2019, an increase in sales from 985 in October 2018 (up 40 per cent) with a 5.9 per cent decrease in the benchmark price year over year. It would seem buyers are taking advantage of opportunities in the townhouse and detached home market as the gap in price between those and condos has come closer over the last two years.

The number of homes for sale in Greater Vancouver dropped significantly this month. At a time when government policies were supposed to be doing the opposite to resale home supply. At the end of September there were 14,242 homes for sale in Greater Vancouver, and at the end of October there were 13,022, the result was pushing some areas and product types into seller’s market conditions. Albeit without the overheated conditions experienced in 2015 and 2016. There were 4,183 new listings during October in Greater Vancouver, down 17 per cent from October last year and down 10 per cent from October 2017. The number of new listings in October 2019 were 5 per cent below the 10-year average for the month of October and 7 per cent below the 20-year average. While the number of detached homes listed for sale across the region has seen the biggest decrease, active listings for condos are now decreasing and more so in Vancouver, North Vancouver and Richmond.

So, did the federal election results in October provide any clarity on policies that may affect the housing market? With a minority Liberal government that has indicated it won’t align with any one party, policy will be that much more difficult to get through. And from the various election platforms, the policies were different amongst the Liberals, Conservatives and NDP parties. So, while it may have been easy to consider foreign buyers as the root cause of a lack of affordability, what we do know is that real estate transactions in Metro Vancouver are very local currently. When the activity increased in May, the percentage of foreign buyers significantly dropped and continued at this lower level through the next 4 months according to numbers released by the provincial government. May through August showed the percentage of transactions attributed to foreign buyers at less than 1.7 per cent with the average for 2019 currently at 2.3 per cent. Given the various policies implemented by government are not producing more supply, and are more so restricting supply where will the blame go if sales activity and prices edge up in the next two years?

“Home buyers have more confidence today than we saw in the first half of the year,” Ashely Smith, Real Estate Board of Greater Vancouver president said. “With prices edging down over the last year and interest rates remaining low, hopeful home buyers are becoming more active this fall. The recent uptick in home sales is moving us into a more historically typical market, both sale and listing activity is trending around our long-term averages in recent months.”

East of the Fraser River, the Fraser Valley Real Estate Board processed 1,592 sales of all property types on its Multiple Listing Service® in October, an increase of 18.5 per cent compared to sales in September and a 37.8 per cent increase compared to the 1,155 sales in October of last year. Active listings for the Fraser Valley finished at 7,398, decreasing 6.9 per cent month-over-month and a decrease of 4.5 per cent when compared to October 2018. There were 2,383 new listings in October, a 14.2 per cent decrease compared to October 2018 and a 13.9 per cent decrease compared to September 2019. “Our market started to pick up in the summer and we’ve been steadily improving since. It’s rare to see October homes sales in the Fraser Valley outpace April and that’s what we’ve seen this year; our typical spring and fall markets have flipped.” said Darin Germyn, President of the Fraser Valley Real Estate Board. “Consumers are feeling more confident. Buyers have grown accustomed to the government’s regulation changes. Interest rates have thankfully remained stable and we’re likely seeing some pent-up demand from buyers who were holding off earlier this year. October’s beautiful, sunny weather didn’t hurt either.”

Here’s a summary of the numbers:

Greater Vancouver: Total Units Sold in October 2019 was 2,892 – up from 2,363 (22%) in September 2019, up from 1,634 (45%) in October 2018, down from 3,073 (6%) in October 2017; Active Listings are at 13,022 compared to 13,682 (down 5%) at this time last year; New Listings in October 2019 were down 17% compared to October 2018 and down 10% compared to October 2017; Month’s Supply of Total Residential Listings is down to 5 Month’s Supply (Balanced to Buyer’s Market conditions with signs of Seller’s Market conditions in some areas and product types) and a Sales to Listings Ratio of 69% compared to 40% in October 2018 and 47% in September 2019.

Vancouver Westside Residential: Total Units Sold in October 2019 was 506 – up from 404 (25%) in September 2019, up from 381 (33%) in October 2018, down from 556 (9%) in October 2017; Active Listings are at 2,278 compared to 2,459 (down 7%) at this time last year; New Listings in October 2019 were down 19% compared to October 2018 and down 12% compared to October 2017; Month’s Supply of Total Residential Listings is down to 5 Month’s Supply (Balanced to Buyer’s Market conditions with signs of Seller’s Market conditions in lower price ranges) and a Sales to Listings Ratio of 62% compared to 37% in October 2018 and 41% in September 2019.

Vancouver East Side Residential: Total Units Sold in October 2019 was 316 – up from 293 (8%) in September 2019, up from 234 (35%) in October 2018, up from 298 (6%) in October 2017; Active Listings are at 1,183 compared to 1,409 (down 16%) at this time last year; New Listings in October 2019 were down 17% compared to October 2018 and down 21% compared to October 2017; Month’s Supply of Total Residential Listings is steady at 4 Month’s Supply (Balanced to Seller’s Market conditions) and a Sales to Listings Ratio of 72% compared to 44% in October 2018 and 51% in September 2019.

North Vancouver Residential: Total Units Sold in October 2019 was 260 – up from 166 (57%) in September 2019, up from 173 (50%) in October 2018, up from 250 (4%) in October 2017; Active Listings are at 777 compared to 938 (down 17%) at this time last year; New Listings in October 2019 were down 27% compared to October 2018 and down 16% compared to October 2017; Month’s Supply of Total Residential Listings is down to 3 Month’s Supply (Balanced to Seller’s Market conditions) and a Sales to Listings Ratio of 76% compared to 37% in October 2018 and 37% in September 2019.

West Vancouver Houses: Total Units Sold in October 2019 was 66 – up from 51 (29%) in September 2019, up from 55 (20%) in October 2018, up from 46 (43%) in October 2017; Active Listings are at 678 compared to 743 (down 9%) at this time last year; New Listings in October 2019 were down 24% compared to October 2018 and down 19% compared to October 2017; Month’s Supply of Total Residential Listings is down to 10 Month’s Supply (Buyer’s Market) and a Sales to Listings Ratio of 42% compared to 26% in October 2018 and 22% in September 2019.

Richmond Residential: Total Units Sold in October 2019 was 345 – up from 283 (22%) in September 2019, up from 230 (45%) in October 2018, down from 411 (16%) in October 2017; Active Listings are at 1,948 compared to 1,878 (down 4%) at this time last year; New Listings in October 2019 were down 13% compared to October 2018 and down 18% compared to October 2017; Month’s Supply of Total Residential Listings is down to 6 Month’s Supply (Balanced to Buyer’s Market conditions) and a Sales to Listings Ratio of 68% compared to 39% in October 2018 and 51% in September 2019.

Burnaby East: Total Units Sold in October 2019 was 26 – up from 22 (18%) in September 2019, up from 17 (53%) in October 2018, up from 22 (18%) in October 2017; Active Listings are at 153 compared to 148 (up 3%) at this time last year; New Listings in October 2019 were the same as October 2018 and down 13% compared to October 2017; Month’s Supply of Total Residential Listings is down to 6 Month’s Supply (Balanced to Buyer’s Market conditions) and a Sales to Listings Ratio of 50% compared to 33% in October 2018 and 39% in September 2019.

Burnaby North: Total Units Sold in October 2019 was 166 – up from 138 (20%) in September 2019, up from 76 (118%) in October 2018, up from 161 (3%) in October 2017; Active Listings are at 517 compared to 556 (down 7%) at this time last year; New Listings in October 2019 were down 17% compared to October 2018 and up 6% compared to October 2017; Month’s Supply of Total Residential Listings is down to 3 Month’s Supply (Balanced to Seller’s Market conditions in some areas and product types) and a Sales to Listings Ratio of 80% compared to 30% in October 2018 and 55% in September 2019.

Burnaby South: Total Units Sold in October 2019 was 157 – up from 119 (32%) in September 2019, up from 87 (80%) in October 2018, down from 184 (15%) in October 2017; Active Listings are at 704 compared to 693 (up 2%) at this time last year; New Listings in October 2019 were down 18% compared to October 2018 and up 3% compared to October 2017; Month’s Supply of Total Residential Listings is down to 4 Month’s Supply (Balanced to Seller’s Market conditions in some areas and product types) and a Sales to Listings Ratio of 68% compared to 31% in October 2018 and 51% in September 2019.

New Westminster: Total Units Sold in October 2019 was 136 – up from 110 (24%) in September 2019, up from 88 (55%) in October 2018, down from 152 (11%) in October 2017; Active Listings are at 430 compared to 511 (down 16%) at this time last year; New Listings in October 2019 were down 34% compared to October 2018 and down 19% compared to October 2017; Month’s Supply of Total Residential Listings is down to 3 Month’s Supply (Balanced to Buyer’s Market conditions with signs of Seller’s Market conditions) and a Sales to Listings Ratio of 85% compared to 36% in October 2018 and 51% in September 2019.

Coquitlam: Total Units Sold in October 2019 was 254 – up from 213 (19%) in September 2019, up from 136 (87%) in October 2018, up from 248 (2%) in October 2017; Active Listings are at 882 compared to 1,026 (down 14%) at this time last year; New Listings in October 2019 were down 11% compared to October 2018 and down 2% compared to October 2017; Month’s Supply of Total Residential Listings is down to 3 Month’s Supply (Balanced to Seller’s Market conditions in some areas and product types) and a Sales to Listings Ratio of 77% compared to 37% in October 2018 and 56% in September 2019.

Port Moody: Total Units Sold in October 2019 was 66 – up from 49 (53%) in September 2019, up from 36 (83%) in October 2018, down from 76 (13%) in October 2017; Active Listings are at 204 compared to 242 (down 16%) at this time last year; New Listings in October 2019 were up 15% compared to October 2018 and down 19% compared to October 2017; Month’s Supply of Total Residential Listings is down to 3 Month’s Supply (Balanced to Seller’s Market conditions in some areas and product types) and a Sales to Listings Ratio of 80% compared to 51% in October 2018 and 52% in September 2019.

Port Coquitlam: Total Units Sold in October 2019 was 107 – up from 78 (37%) in September 2019, up from 75 (43%) in October 2018, down from 120 (11%) in October 2017; Active Listings are at 296 compared to 357 (down 17%) at this time last year; New Listings in October 2019 were down 21% compared to October 2018 and down 3% compared to October 2017; Month’s Supply of Total Residential Listings is down to 3 Month’s Supply (Balanced to Seller’s Market conditions in some areas and product types) and a Sales to Listings Ratio of 84% compared to 46% in October 2018 and 54% in September 2019.

Ladner: Total Units Sold in October 2019 was 34 – up from 28 (21%) in September 2019, up from 22 (55%) in October 2018, up from 31 (10%) in October 2017; Active Listings are at 180 compared to 177 (up 2%) at this time last year; New Listings in October 2019 were up 16% compared to October 2018 and up 27% compared to October 2017; Month’s Supply of Total Residential Listings is down to 5 Month’s Supply (Balanced to Buyer’s Market conditions in some areas and product types) and a Sales to Listings Ratio of 52% compared to 50% in October 2018 and 51% in September 2019.

Tsawwassen: Total Units Sold in October 2019 was 32 – up from 26 (23%) in September 2019, up from 25 (25%) in October 2018, down from 40 (20%) in October 2017; Active Listings are at 296 compared to 230 (down 29%) at this time last year; New Listings in October 2019 were up 19% compared to October 2018 and up 27% compared to October 2017; Month’s Supply of Total Residential Listings is down to 9 Month’s Supply (Buyer’s Market) and a Sales to Listings Ratio of 40% compared to 37% in October 2018 and 33% in September 2019.

Pitt Meadows: Total Units Sold in October 2019 was 31 – down from 32 (4%) in September 2019, the same as October 2018, down from 35 (11%) in October 2017; Active Listings are at 104 compared to 115 (down 9%) at this time last year; New Listings in October 2019 were up 33% compared to October 2018 and up 11% compared to October 2017; Month’s Supply of Total Residential Listings is steady at 3 Month’s Supply (Balanced to Seller’s Market conditions in some areas and product types) and a Sales to Listings Ratio of 64% compared to 86% in October 2018 and 54% in September 2019.

Maple Ridge: Total Units Sold in October 2019 was 180 – up from 145 (24%) in September 2019, down from 183 (2%) in October 2018, the same as October 2017; Active Listings are at 765 compared to 703 (up 8%) at this time last year; New Listings in October 2019 were down 17% compared to October 2018 and down 18% compared to October 2017; Month’s Supply of Total Residential Listings is down to 4 Month’s Supply (Balanced to Seller’s Market conditions in some areas and product types) and a Sales to Listings Ratio of 74% compared to 49% in October 2018 and 55% in September 2019.

Kevin Skipworth

Managing Broker/Partner

The average MLS® residential price in the province was $697,943, an increase of 2.1 per cent from September 2018. Total sales dollar volume was $4.84 billion, a 26.5 per cent increase from the same month last year.

The average MLS® residential price in the province was $697,943, an increase of 2.1 per cent from September 2018. Total sales dollar volume was $4.84 billion, a 26.5 per cent increase from the same month last year.