Where to begin. This month’s numbers for Greater Vancouver real estate are a tale of what could have been, not so much what will be. The way sales on a given day are counted by the Real Estate Board of Greater Vancouver are by looking at the day when that sale is reported by a real estate company to the Board, regardless of when the date the contract is written. So, there is a time lag between when the contract is written and when it is reported. This will be important in looking at sales figures for March as a degree of that activity came from transactions that were initiated prior to mid-March.

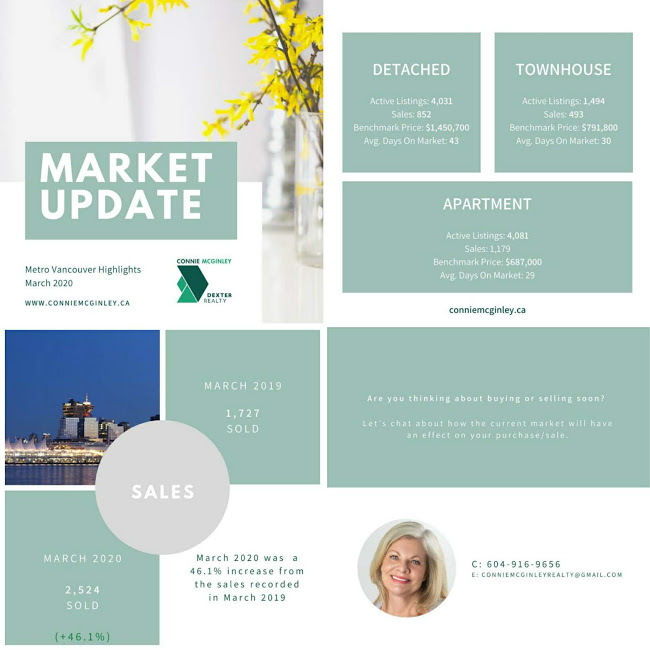

There were 2,562 homes sold of all types in Greater Vancouver in March this year compared with 2,185 homes sold last month, 1,745 sales in March last year and 2,551 homes sold in March 2018. Sales in March were 19 per cent below the 10-year average for the month of March. The number of sales in March were 47 per cent higher compared to March 2019, continuing the trend for the ninth straight month where year-over-year sales were up. This trend is likely to stop in April as the effect of the COVID-19 Virus impacts the real estate market.

Some highlights from March:

- North Vancouver was one of the few areas that saw a decline in the number of sales in March compared to February and the number of detached homes sold was below that of March 2019

- Year over year, the increase in detached homes sold was the greatest at 61 per cent, townhouses followed at 51 per cent with apartments at 35 per cent

- Year over year the decrease in the number of active listings for detached homes was the greatest at 28 per cent, followed by townhouses at 27 per cent and then apartments at 19 per cent

Beyond the Pandemic:

The COVID-19 crisis will continue over the next number of months, a timeframe which is impossible to determine at this time. The numbers show that Greater Vancouver was in the stages of a market gaining momentum. While the market was still reaching for average, it was still vastly improved from last year which was a very challenged real estate market. Pent up demand was coming to the market, and from the provincial numbers identifying a very small number of foreign buyers, these were local buyers. While the real estate market takes a pause for the short term, there are many reasons to think it will be very active when we see some relief from virus, and in some cases why we may see activity over the next few months.

- Detached/townhouse will be more attractive and in greater demand after this as people want dwellings with social distancing – people will make personal and financial sacrifices for health

- Those in sectors where the most job losses are occurring in higher numbers aren’t the typical buyers in the market

- After isolation people will grow tired of their homes and want a change

- Unfortunately, some marriages may not survive after this hence people will need to move

- In 9 to 12 months there likely will be a mini-baby boom hence people will need to move

- Having not spent disposable income as much, people are in saving modes and that will carry on beyond this and will add to what’s available for home purchasing (even with reduced incomes, many of the home buyers are still earning an income)

- Interest rates will be low for the foreseeable future, lowest we’ve seen

- With so many sectors in the economy suffering that are important to government revenue, and as they struggle to recover, the government will need investment and revenue from real estate

- There will be a shortage of homes available coming out of this and continuing so prices will not be dropping to any great degree, and new construction will suffer which will perpetuate the shortage in the years to come

- Stock markets will continue to be volatile, pushing money into real estate, especially at higher price points

- Canada’s response to Covid-19 is showing it a favourable place to be – immigration and investment will likely flourish with the United States potentially being a source of those coming to Canada.

The number of homes for sale in Greater Vancouver saw a slight increase in March. At the end of March there were 10,338 homes for sale in Greater Vancouver, compared to 9,894 at the end of February and 13,408 at the end of March 2019. While it may be surprising that we had that many new listings during the current pandemic, April will be more telling of the effects. But we saw 2,511 new listings up to March 15 and then 2,010 after that. The number of new listings per day did start to decline in the days leading up to the end of the month, but we are still seeing listings coming on (233 in Greater Vancouver in the last two days of the month.) Current market conditions are still producing some multiple offers – in all product types. While it may seem like a high number of new listings for current conditions, it is still well below what we would see for March in Greater Vancouver. There were 4,421 new listings during March in Greater Vancouver, down 11 per cent from March last year. The number of new listings in March were 22 per cent below the 10-year average for the month.

The first two weeks of the month were the busiest days of the year for our region with heightened demand and multiple offers becoming more common,” Ashley Smith, REBGV president said, “Like other aspects of our lives, this changed as concerns over the COVID-19 situation in our province grew. “Many of the sales recorded in March were in process before the provincial government declared a state of emergency. We’ll need more time to pass to fully understand the impact that the pandemic is having on the housing market,” Smith said.

East of the Fraser River, the Fraser Valley Real Estate Board processed 1,441 sales of all property types on its Multiple Listing Service® in March, an increase of 7 per cent compared to sales in February and a 18 per cent increase compared to the sales in March of last year. According to the Fraser Valley Board, during the first 7 business days of the month, property sales were tracking 60 per cent higher compared to the same period in March of last year, however finished significantly lower. Active listings for the Fraser Valley finished 6 per cent higher month-over-month and decreased of 13 per cent when compared to March 2019. There were 2,666 new listings in March, a 4 per cent increase compared to February 2020 and a 7 per cent decrease compared to March 2019.

Above all else, right now is a time to focus on staying safe and healthy. There will be real estate activity while we are under these unprecedented times, some people’s financial wellbeing may depend upon it. Others just need a home to isolate in. What’s important is that we all act in a way to help bring back normalcy to our lives – as much as that can be. Be safe and be careful.

Here’s a summary of the numbers:

Greater Vancouver: Total Units Sold in March 2020 was 2,562 – up from 2,185 (17%) in February 2020, up from 1,745 (47%) in March 2019, up from 2,551 (0%) in March 2018; Active Listings are at 10,315 compared to 13,408 (down 23%) at this time last year; New Listings in March 2020 were down 11% compared to March 2019 and down 1% compared to March 2018. Month’s Supply of Total Residential Listings is at 4 Month’s Supply (Balanced with signs of Seller’s Market conditions in some areas and product types) and a Sales to Listings Ratio of 57% compared to 35% in March 2019 and 51% in March 2018.

Vancouver Westside Residential: Total Units Sold in March 2020 was 467 – up from 367 (27%) in February 2020, up from 333 (40%) in March 2019, up from 441 (6%) in March 2018; Active Listings are at 1,814 compared to 2,511 (down 28%) at this time last year; New Listings in March 2020 were down 15% compared to March 2019 and down 5% compared to March 2018. Month’s Supply of Total Residential Listings is at 4 Month’s Supply (Balanced with signs of Seller’s Market conditions in some areas and product types) and a Sales to Listings Ratio of 55% compared to 34% in March 2019 and 49% in March 2018.

Vancouver East Side Residential: Total Units Sold in March 2020 was 297 – up from 243 (22%) in February 2020, up from 174 (71%) in March 2019, up from 284 (5%) in March 2018; Active Listings are at 834 compared to 1,239 (down 33%) at this time last year; New Listings in March 2020 were down 9% compared to March 2019 and down 9% compared to March 2018. Month’s Supply of Total Residential Listings is at 3 Month’s Supply (Seller’s Market conditions in some areas and product types) and a Sales to Listings Ratio of 64% compared to 34% in March 2019 and 55% in March 2018.

North Vancouver Residential: Total Units Sold in March 2020 was 204 – down from 206 (1%) in February 2020, up from 165 (24%) in March 2019, down from 216 (6%) in March 2018; Active Listings are at 640 compared to 883 (down 28%) at this time last year; New Listings in March 2020 were down 9% compared to March 2019 and down 2% compared to March 2018. Month’s Supply of Total Residential Listings is at 3 Month’s Supply (Balanced with mostly Seller’s Market conditions) and a Sales to Listings Ratio of 57% compared to 42% in March 2019 and 60% in March 2018.

West Vancouver: Total Units Sold in March 2020 was 56 – down from 57 (2%) in February 2020, up from 34 (65%) in March 2019, up from 42 (36%) in March 2018; Active Listings are at 553 compared to 670 (down 20%) at this time last year; New Listings in March 2020 were the same compared to March 2019 and up 9% compared to March 2018. Month’s Supply of Total Residential Listings is at 10 Month’s Supply (Buyer’s Market conditions) and a Sales to Listings Ratio of 33% compared to 20% in March 2019 and 27% in March 2018.

Richmond Residential: Total Units Sold in March 2020 was 337 – up from 253 (33%) in February 2020, up from 178 (89%) in March 2019, up from 306 (10%) in March 2018; Active Listings are at 1,464 compared to 2,025 (down 28%) at this time last year; New Listings in March 2020 were up 23% compared to March 2019 and down 14% compared to March 2018. Month’s Supply of Total Residential Listings is at 4 Month’s Supply (Balanced Market conditions) and a Sales to Listings Ratio of 64% compared to 26% in March 2019 and 50% in March 2018.

Burnaby East: Total Units Sold in March 2020 was 27 – down from 32 (16%) in February 2020, up from 17 (59%) in March 2019, up from 26 (4%) in March 2018; Active Listings are at 101 compared to 141 (down 28%) at this time last year; New Listings in March 2020 were up 6% compared to March 2019 and up 17% compared to March 2018. Month’s Supply of Total Residential Listings is at 4 Month’s Supply (Balanced with signs of Seller’s Market conditions in some areas and product types) and a Sales to Listings Ratio of 56% compared to 33% in March 2019 and 63% in March 2018.

Burnaby North: Total Units Sold in March 2020 was 130 – up from 100 (30%) in February 2020, up from 77 (69%) in March 2019, down from 131 (1%) in March 2018; Active Listings are at 392 compared to 536 (down 27%) at this time last year; New Listings in March 2020 were down 1% compared to March 2019 and up 3% compared to March 2018. Month’s Supply of Total Residential Listings is at 3 Month’s Supply (Balanced with signs of Seller’s Market conditions in some areas and product types) and a Sales to Listings Ratio of 59% compared to 34% in March 2019 and 61% in March 2018.

Burnaby South: Total Units Sold in March 2020 was 143 – up from 105 (36%) in February 2020, up from 97 (47%) in March 2019, up from 103 (39%) in March 2018; Active Listings are at 482 compared to 771 (down 37%) at this time last year; New Listings in March 2020 were down 24% compared to March 2019 and up 12% compared to March 2018. Month’s Supply of Total Residential Listings is at 3 Month’s Supply (Balanced with signs of Seller’s Market conditions in some areas and product types) and a Sales to Listings Ratio of 65% compared to 33% in March 2019 and 53% in March 2018.

New Westminster: Total Units Sold in March 2020 was 118 – up from 90 (20%) in February 2020, up from 81 (46%) in March 2019, down from 149 (21%) in March 2018; Active Listings are at 350 compared to 472 (down 26%) at this time last year; New Listings in March 2020 were down 2% compared to March 2019 and up 3% compared to March 2018. Month’s Supply of Total Residential Listings is at 3 Month’s Supply (Balanced with signs of Seller’s Market conditions in some areas and product types) and a Sales to Listings Ratio of 59% compared to 40% in March 2019 and 77% in March 2018.

Coquitlam: Total Units Sold in March 2020 was 202 – up from 196 (19%) in February 2020, up from 142 (42%) in March 2019, down from 204 (1%) in March 2018; Active Listings are at 696 compared to 933 (down 25%) at this time last year; New Listings in March 2020 were down 5% compared to March 2019 and up 20% compared to March 2018. Month’s Supply of Total Residential Listings is at 3 Month’s Supply (Balanced with signs of Seller’s Market conditions in some areas and product types) and a Sales to Listings Ratio of 52% compared to 35% in March 2019 and 63% in March 2018.

Port Moody: Total Units Sold in March 2020 was 54 – up from 36 (50%) in February 2020, up from 38 (42%) in March 2019, down from 57 (5%) in March 2018; Active Listings are at 199 compared to 210 (down 5%) at this time last year; New Listings in March 2020 were up 9% compared to March 2019 and up 33% compared to March 2018. Month’s Supply of Total Residential Listings is at 4 Month’s Supply (Balanced with signs of Seller’s Market conditions in some areas and product types) and a Sales to Listings Ratio of 52% compared to 40% in March 2019 and 73% in March 2018.

Port Coquitlam: Total Units Sold in March 2020 was 96 – up from 83 (16%) in February 2020, up from 59 (63%) in March 2019, down from 103 (7%) in March 2018; Active Listings are at 194 compared to 168 (up 15%) at this time last year; New Listings in March 2020 were up 15% compared to March 2019 and up 9% compared to March 2018. Month’s Supply of Total Residential Listings is at 2 Month’s Supply (Seller’s Market conditions) and a Sales to Listings Ratio of 68% compared to 35% in March 2019 and 82% in March 2018.

Ladner: Total Units Sold in March 2020 was 32 – down from 36 (11%) in February 2020, up from 25 (28%) in March 2019, up from 24 33%) in March 2018; Active Listings are at 171 compared to 170 (up 1%) at this time last year; New Listings in March 2020 were down 13% compared to March 2019 and up 22% compared to March 2018. Month’s Supply of Total Residential Listings is at 5 Month’s Supply (Balanced Market conditions) and a Sales to Listings Ratio of 48% compared to 32% in March 2019 and 44% in March 2018.

Tsawwassen: Total Units Sold in March 2020 was 39 – up from 32 (22%) in February 2020, up from 15 (160%) in March 2019, and the same at 39 in March 2018; Active Listings are at 218 compared to 236 (down 8%) at this time last year; New Listings in March 2020 down up 12% compared to March 2019 and down 14% compared to March 2018. Month’s Supply of Total Residential Listings is at 6 Month’s Supply (Balanced Market conditions) and a Sales to Listings Ratio of 52% compared to 18% in March 2019 and 45% in March 2018.

Pitt Meadows: Total Units Sold in March 2020 was 35 – up from 27 (30%) in February 2020, up from 24 (45%) in March 2019, up from 34 (21%) in March 2018; Active Listings are at 102 compared to 119 (down 14%) at this time last year; New Listings in March 2020 were up 20% compared to March 2019 and up 94% compared to March 2018. Month’s Supply of Total Residential Listings is at 3 Month’s Supply (Mostly a Seller’s Market with some Balanced Market Conditions) and a Sales to Listings Ratio of 53% compared to 43% in March 2019 and 100% in March 2018.

Maple Ridge: Total Units Sold in March 2020 was 170 – down from 177 (48%) in February 2020, up from 116 (46%) in March 2019, down from 180 (6%) in March 2018; Active Listings are at 659 compared to 675 (down 2%) at this time last year; New Listings in March 2020 were up 14% compared to March 2019 and up 5% compared to March 2018. Month’s Supply of Total Residential Listings is at 4 Month’s Supply (Mostly a Seller’s Market with some Balanced Market Conditions) and a Sales to Listings Ratio of 57% compared to 44% in March 2019 and 63% in March 2018.

Kevin Skipworth

Managing Broker/Partner