Attached are the Sales and Listings Stats updated to the end of August 2019. Considering August is traditionally one of the slower months for real estate sales, this August was more active than anticipated. On the supply side, the number of new listings and active listings were down – showing buyers are engaging more than they have and sellers are willing to hold on to their properties. Once again, there is a noticeable increase in demand for homes in August, similar to July, with anecdotal reports of multiple offers and properties that have been on the market for a number of months getting activity and offers. Prices have already come down (despite reports that they are just starting to come down) which has piqued the interest of buyers and allowed some buyers priced out by the mortgage stress test, to come back in to the market.

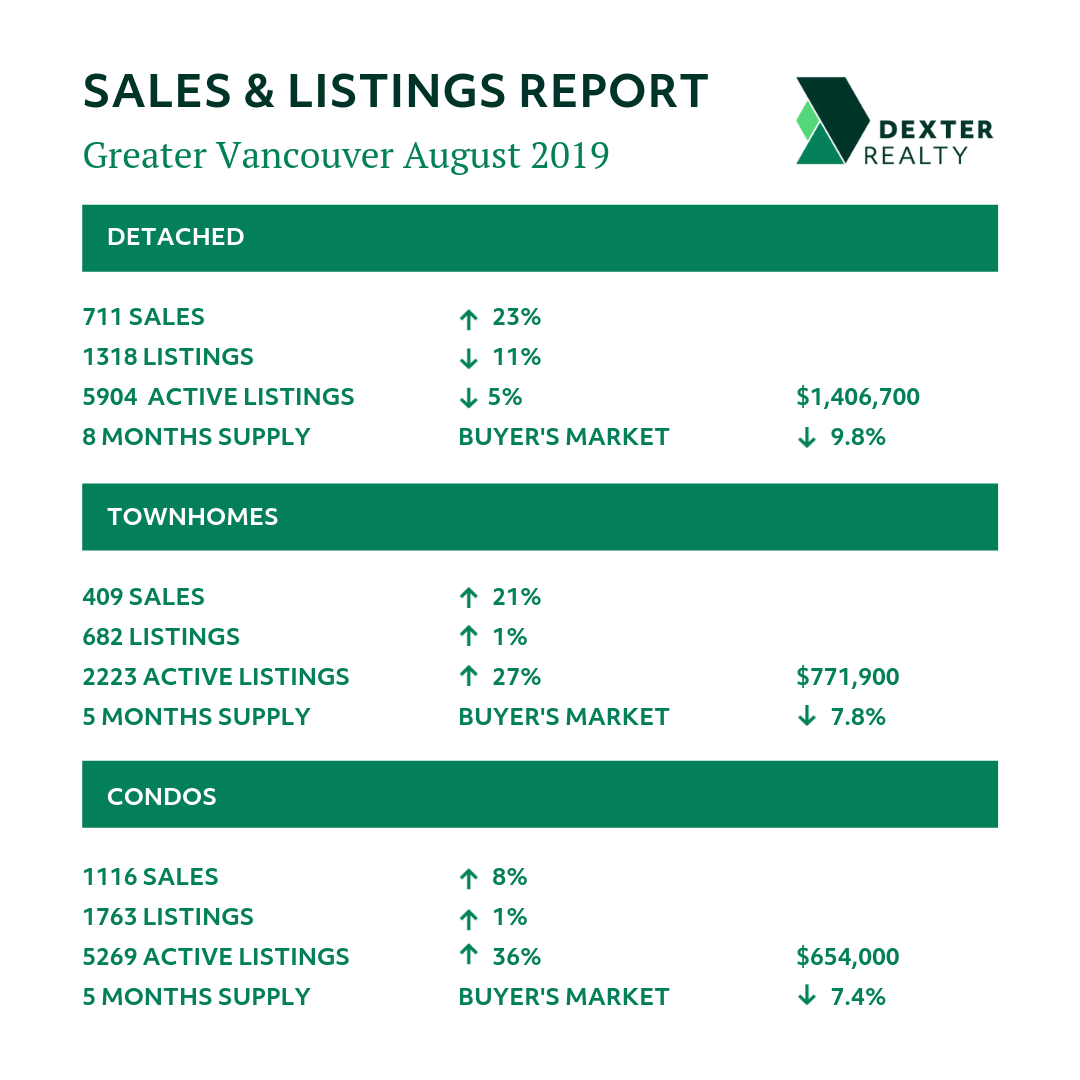

There were 2,256 homes sold of all types in Greater Vancouver in August this year compared with 2,584 homes sold last month, 1,961 sales in August last year and 3,097 homes sold in August 2017. August sales were 10 per cent below the 10-year average for this month. In the last three market downturns, (2008, 2012 and 2018) August was the start of the market decline. In fact, in 2008 there were 1,654 sales in August and in 2012 there were 1,670 homes sold. This August had a much different feeling to it. With the supply of listings shrinking, buyers have been more engaged and focusing on the more desirably priced homes. There were 711 detached houses sold in August 2019 up from 575 (23 per cent) in August 2018 in Greater Vancouver, with a 9.8 per cent decrease in the benchmark price of these homes year over year. For townhouses there were 409 sales in August 2019 compared to 337 in August 2018 (up 21 per cent) with a 7.8 per cent decrease in the benchmark price year over year; and for condos there were 1,116 sales in August 2019, an increase in sales from 1,025 in August 2018 (up 8 per cent) with an 7.4 per cent decrease in the benchmark price year over year. Houses are getting more and more attention from buyers as the price gap between houses and condos has shrunk and with interest rates coming down, that opportunity will continue to grow.

As for the supply homes in Greater Vancouver, there was a decrease in the number of new listings in August compared to last month and August of last year. There were 3,843 new listings during August in Greater Vancouver, down 3 per cent from August last year and down 12 per cent from August 2017 – the same as July in comparison to the last two years. Clearly there isn’t a panic amongst sellers to list. The number of new listings in August 2019 were 9 per cent below the 10-year average for the month of August. Active Listings are at 14,191 for month end (up 13 per cent compared to August 2018) and after listing expiries at month’s end, there were only 13,813 active listings at the start of September. The month by month drop in active listings is continuing, so with inventory shrinking this is leaving a greater proportion of listings that have been on the market for an extended period of time and the land assembly properties.

The funny thing about supply and demand in today’s real estate market is that the total number of homes in Metro Vancouver has grown considerably since the 1990’s yet total number of monthly sales had been relatively the same during the various market cycles in the last 30 years. Home sales in 2015 and 2016 were among the highest on record, which is to be expected when the total market size has increased significantly. With the limited number of home sales in the last two years, there will be significant pent up demand. And demand is not the same as it was 30 years ago. Demographics show that younger generations are staying single longer, and some when coming together keep both properties making one a rental. Divorce rates are higher than before, requiring one household to turn into 2. And of course, people are living longer and staying in homes longer than before. To suggest that demand for housing comes from population growth and that’s how to determine the need, doesn’t take into account all the other factors that drive the need for homes. And we haven’t even talked about potential effects from Hong Kong. Which begs the question, why is supply not an issue?

“Homes sales returned to more historically normal levels in July and August compared to what we saw in the first six months of the year,” Ashely Smith, Real Estate Board of Greater Vancouver president said. “With more demand from home buyers, the supply of homes listed for sale isn’t accumulating like earlier in the year. These changes are creating more balanced market conditions”

East of the Fraser River, the Fraser Valley Real Estate Board processed 1,297 sales of all property types on its Multiple Listing Service® in August, a decrease of 11 per cent compared to sales in July and a 12.3 per cent increase compared to the 1,155 sales in August of last year. Active listings for the Fraser Valley finished at 8,040, decreasing 3.6 per cent month-over-month and an increase of 9.6 per cent when compared to August 2018. There were 2,357 new listings in August, an 8.5 per cent decrease compared to August 2018. “Compared to last year, this August as been quite robust. All property types are selling and we’re seeing a resurgence in the single-family detached market. Across North Delta, Surrey and Langley, sales are up over 25 per cent.” said Darin Germyn, President of the Fraser Valley Real Estate Board. “It’s great to see. We’re returning to a normal, steady market. Our sales, new listings and number of active listings in August were all slightly below the 10-year average.”

Here’s a summary of the numbers:

Greater Vancouver: Total Units Sold in August 2019 was 2,256 – down from 2,584 (13%) in July 2019, up from 1,961 (15%) in August 2018, down from 3,097 (27%) in August 2017; Active Listings are at 14,191 compared to 12,519 (up 13%) at this time last year; New Listings in August 2019 were down 3% compared to August 2018 and down 12% compared to August 2017; Month’s Supply of Total Residential Listings is steady at 6 Month’s Supply (Balanced to Buyer’s Market conditions in some areas and product types and price range) and a Sales to Listings Ratio of 59% compared to 49% in August 2018 and 55% in July 2019.

Vancouver Westside Residential: Total Units Sold in August 2019 was 423 – down from 489 (13%) in July 2019, up from 371 (14%) in August 2018, down from 516 (18%) in August 2017; Active Listings are at 2,326 compared to 2,158 (up 8%) at this time last year; New Listings in August 2019 were down 12% compared to August 2018 and down 16% compared to August 2017; Month’s Supply of Total Residential Listings is steady at 5 Month’s Supply (Balanced to Buyer’s Market conditions in some areas and product types and price range) and a Sales to Listings Ratio of 67% compared to 51% in August 2018 and 55% in July 2019.

Vancouver Eastside Residential: Total Units Sold in August 2019 was 235 – down from 277 (15%) in July 2019, up from 191 (23%) in August 2018, down from 288 (18%) in August 2017; Active Listings are at 1,233 compared to 1,326 (down 7%) at this time last year; New Listings in August 2019 were down 9% compared to August 2018 and down 14% compared to August 2017; Month’s Supply of Total Residential Listings is steady at 5 Month’s Supply (Balanced to Buyer’s Market conditions in some areas and product types and price range) and a Sales to Listings Ratio of 65% compared to 48% in August 2018 and 59% in July 2019.

North Vancouver Residential: Total Units Sold in August 2019 was 184 – down from 205 (10%) in July 2019, up from 131 (40%) in August 2018, down from 217 (15%) in August 2017; Active Listings are at 838 compared to 739 (up 13%) at this time last year; New Listings in August 2019 were up 3% compared to August 2018 and the same compared to August 2017; Month’s Supply of Total Residential Listings is steady at 5 Month’s Supply (Balanced to Buyer’s Market conditions in some areas and product types and price range) and a Sales to Listings Ratio of 70% compared to 51% in August 2018 and 56% in July 2019.

West Vancouver Houses: Total Units Sold in August 2019 was 49 – down from 59 (17%) in July 2019, up from 46 (6%) in August 2018, down from 50 (2%) in August 2017; Active Listings are at 690 compared to 716 (down 4%) at this time last year; New Listings in August 2019 were down 4% compared to August 2018 and the same compared to August 2017; Month’s Supply of Total Residential Listings is up to 14 Month’s Supply (Buyer’s Market) and a Sales to Listings Ratio of 36% compared to 32% in August 2018 and 39% in July 2019.

Richmond Residential: Total Units Sold in August 2019 was 250 – down from 301 (17%) in July 2019, down from 266 (6%) in August 2018, down from 454 (45%) in August 2017; Active Listings are at 2,210 compared to 1,785 (up 24%) at this time last year; New Listings in August 2019 were down 10% compared to August 2018 and down 26% compared to August 2017; Month’s Supply of Total Residential Listings is up to 9 Month’s Supply (Balanced to Buyer’s Market conditions in some areas and product types and price range) and a Sales to Listings Ratio of 48% compared to 47% in August 2018 and 49% in July 2019.

Burnaby East: Total Units Sold in August 2019 was 31 – up from 14 (221%) in July 2019, up from 21 (48%) in August 2018, up from 30 (3%) in August 2017; Active Listings are at 159 compared to 126 (up 26%) at this time last year; New Listings in August 2019 were up 39% compared to August 2018 and down 7% compared to August 2017; Month’s Supply of Total Residential Listings is down to 5 Month’s Supply (Balanced to Buyer’s Market conditions in some areas and product types and price range) and a Sales to Listings Ratio of 58% compared to 55% in August 2018 and 31% in July 2019.

Burnaby North: Total Units Sold in August 2019 was 129 – down from 132 (2%) in July 2019, up from 82 (57%) in August 2018, down from 166 (22%) in August 2017; Active Listings are at 591 compared to 482 (up 27%) at this time last year; New Listings in August 2019 were down 13% compared to August 2018 and up 3% compared to August 2017; Month’s Supply of Total Residential Listings is steady at 5 Month’s Supply (Balanced to Buyer’s Market conditions in some areas and product types and price range) and a Sales to Listings Ratio of 61% compared to 44% in August 2018 and 56% in July 2019.

Burnaby South: Total Units Sold in August 2019 was 126 – down from 152 (17%) in July 2019, up from 94 (34%) in August 2018, down from 168 (25%) in August 2017; Active Listings are at 792 compared to 614 (up 29%) at this time last year; New Listings in August 2019 were up 22% compared to August 2018 and down 5% compared to August 2017; Month’s Supply of Total Residential Listings is up to 6 Month’s Supply (Balanced to Buyer’s Market conditions in some areas and product types and price range) and a Sales to Listings Ratio of 51% compared to 46% in August 2018 and 64% in July 2019.

New Westminster: Total Units Sold in August 2019 was 97 – down from 122 (20%) in July 2019, up from 90 (7%) in August 2018, down from 170 (43%) in August 2017; Active Listings are at 498 compared to 382 (up 30%) at this time last year; New Listings in August 2019 were up 2% compared to August 2018 and down 19% compared to August 2017; Month’s Supply of Total Residential Listings is up to 5 Month’s Supply (Balanced to Buyer’s Market conditions in some areas and product types and price range) and a Sales to Listings Ratio of 58% compared to 56% in August 2018 and 61% in July 2019.

Coquitlam: Total Units Sold in August 2019 was 198 – down from 236 (16%) in July 2019, up from 183 (8%) in August 2018, down from 249 (20%) in August 2017; Active Listings are at 1,059 compared to 971 (up 9%) at this time last year; New Listings in August 2019 were down 4% compared to August 2018 and down 8% compared to August 2017; Month’s Supply of Total Residential Listings is steady at 5 Month’s Supply (Balanced to Buyer’s Market conditions in some areas and product types and price range) and a Sales to Listings Ratio of 56% compared to 50% in August 2018 and 54% in July 2019.

Port Moody: Total Units Sold in August 2019 was 39 – down from 56 (30%) in July 2019, up from 29 (34%) in August 2018, down from 67 (42%) in August 2017; Active Listings are at 226 compared to 201 (up 12%) at this time last year; New Listings in August 2019 were down 36% compared to August 2018 and down 5% compared to August 2017; Month’s Supply of Total Residential Listings is up to 6 Month’s Supply (Balanced to Buyer’s Market conditions in some areas and product types and price range) and a Sales to Listings Ratio of 51% compared to 52% in August 2018 and 75% in July 2019.

Port Coquitlam: Total Units Sold in August 2019 was 79 – down from 86 (8%) in July 2019, up from 72 (10%) in August 2018, down from 115 (31%) in August 2017; Active Listings are at 338 compared to 336 (up 1%) at this time last year; New Listings in August 2019 were down 21% compared to August 2018 and down 36% compared to August 2017; Month’s Supply of Total Residential Listings is steady at 4 Month’s Supply (Balanced to Buyer’s Market conditions in some areas and product types and price range) and a Sales to Listings Ratio of 68% compared to 49% in August 2018 and 57% in July 2019.

Ladner: Total Units Sold in August 2019 was 33 – down from 34 (3%) in July 2019, up from 23 (43%) in August 2018, down from 40 (17%) in August 2017; Active Listings are at 192 compared to 168 (up 14%) at this time last year; New Listings in August 2019 were up 46% compared to August 2018 and up 86% compared to August 2017; Month’s Supply of Total Residential Listings is steady at 6 Month’s Supply (Balanced to Buyer’s Market conditions in some areas and product types and price range) and a Sales to Listings Ratio of 49% compared to 50% in August 2018 and 58% in July 2019.

Tsawwassen: Total Units Sold in August 2019 was 30 – down from 46 (35%) in July 2019, up from 25 (20%) in August 2018, down from 40 (25%) in August 2017; Active Listings are at 294 compared to 227 (up 30%) at this time last year; New Listings in August 2019 were up 62% compared to August 2018 and up 33% compared to August 2017; Month’s Supply of Total Residential Listings is up to 10 Month’s Supply (Balanced to Buyer’s Market conditions in some areas and product types and price range) and a Sales to Listings Ratio of 41% compared to 56% in August 2018 and 65% in July 2019.

Pitt Meadows: Total Units Sold in July 2019 was 39 – up from 20 (95%) in July 2019, up from 23 (70%) in August 2018, down from 47 (17%) in August 2017; Active Listings are at 118 compared to 117 (up 2%) at this time last year; New Listings in August 2019 were down 19% compared to August 2018 and down 17% compared to August 2017; Month’s Supply of Total Residential Listings down to 3 Month’s Supply (Balanced to Buyer’s Market) and a Sales to Listings Ratio of 102% compared to 48% in August 2018.

Maple Ridge: Total Units Sold in August 2019 was 133 – down from 182 (27%) in July 2019, up from 121 (9%) in August 2018, down from 194 (31%) in August 2017; Active Listings are at 831 compared to 648 (up 28%) at this time last year; New Listings in August 2019 were down 15% compared to August 2018 and up 9% compared to August 2017; Month’s Supply of Total Residential Listings is up to 6 Month’s Supply (Balanced Market) and a Sales to Listings Ratio of 63% compared to 48% in August 2018.

Kevin Skipworth

Managing Broker/Partner

Comments:

Post Your Comment: